Compensation:

remuneration and securities ownership

Our compensation policies are an essential component of our strategy and as such a key driver of organisational performance.

They are an essential component of our employee value proposition and a key driver of both individual and business performance. Rigorous governance, policies and processes ensure that our compensation practices are aligned with our principles of integrity, fairness and transparency.

We have aligned our performance target setting for executives with the Givaudan strategy: it includes both financial metrics and non-financial (ESG) criteria.

Our remuneration policy is based on the following principles:

- Pay for performance.

- Alignment of interests.

- External competitiveness.

- Internal consistency and fairness.

Total compensation in 2025 is composed of the following elements:

- Base salary for all employees.

- Benefits for all employees (including retirement, insurance and health care plans).

- Cash-based Profit Sharing Plan for approximately 11,000 non-management employees based on Group financial objectives.

- Cash-based Annual Incentive Plan for around 6,000 managers and executives.

- Equity-based Performance Share Plan (PSP) for the top 500 employees.

Base salaries are regularly benchmarked in each location and pay scales are reviewed annually according to local market evolution. As a general rule, pay scales are built around market median. Benefit plans seek to address current and future security needs of employees. These generally include retirement, health, death and disability benefits.

Benefit plans seek to address current and future security needs of employees. These generally include retirement, health, death and disability benefits.

Non-management employees participate in the global Profit Sharing Plan. Payouts are based on the yearly evolution of Group EBITDA.

The Annual Incentive Plan covers all managers and executives globally. It rewards participants for the achievement of financial targets and other organisational and individual objectives.

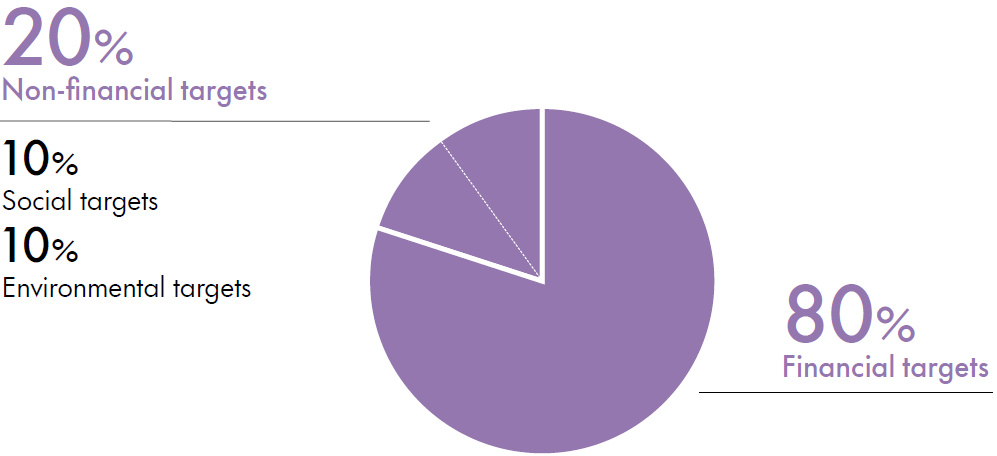

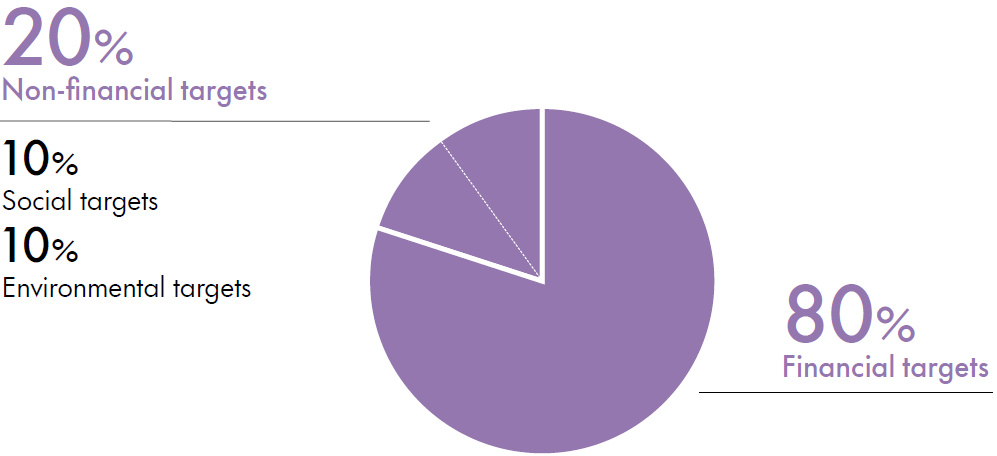

The PSP is designed to reward executives and key talent who significantly influence the long-term success of the business and our purpose ambitions. From 1 January 2021, a new PSP aligned with the Givaudan purpose was introduced. The financial metrics of sales and free cash flow traditionally used to calculate the PSP are retained, and are complemented by non-financial criteria linked to three of the four focus areas of the Givaudan purpose:

- Creations: Financial targets of sales and free cash flow

- Nature: Environmental targets of net GHG emissions reduction

- People: Social targets of senior leader diversity and employee safety

Performance Share Plan for top 500 employees

Compensation of the Board of Directors

Compensation of Board members consists of Director fees, Committee fees and Restricted Share Units (RSUs). Fees are paid at the end of each completed year in office. RSUs give participants the right to receive Givaudan shares (or a cash equivalent in countries where securities laws prevent the offering of Givaudan securities) at the end of a three-year blocking period. During this period, Board members must hold RSUs (accordingly are restricted from trading RSUs or the underlying Givaudan shares), thereby aligning with shareholder interests over the longer term. Board members are entitled to receive Givaudan shares regardless of membership status so that, for example, if re-election does not occur during the restriction period, awarded RSUs are retained by the respective Board member. Such practice has been implemented in line with best practice in support of Givaudan’s commitment to ensuring Board independence.

The compensation paid to the Board members for the period between the 2024 and 2025 Annual General Meetings, CHF 2,848,102, is again within the amount approved by shareholders at the 2024 Annual General Meeting CHF CHF 3,000,000.

Amounts approved at the 2025 Annual General Meeting, CHF 3,000,000, will be paid by the end of the year in office and validated in the 2026 Compensation Report. Such approved and paid amounts may differ from those shown in the Board compensation summary table which, according to the Swiss Obligations Law, must include compensation paid in the reporting year.

Board of Directors compensation summary

| in Swiss francs | DIRECTOR FEES (3) | COMMITTEE FEES (3) | TOTAL FIXED (CASH) | NUMBER OF RSUs GRANTED (4) | VALUE AT GRANT (5) | TOTAL COMPENSATION | |

|---|---|---|---|---|---|---|---|

Calvin Grieder Chairman (1) | 2025 |

|

| 446.250 | 162 | 579,506 | 1,025,756 |

| 2024 | 400,000 | 65,000 | 465,000 | 152 | 579,242 | 1,044,242 |

Victor Balli (1) | 2025 |

|

|

|

|

| 326,665 |

| 2024 | 100,000 | 80,000 | 180,000 | 38 | 144,810 | 324,810 |

Ingrid Deltenre (1) | 2025 |

|

|

|

|

| 326,665 |

| 2024 | 100,000 | 65,000 | 165,000 | 38 | 144,810 | 309,810 |

Olivier Filliol (1) | 2025 |

|

|

|

|

| 73,703 |

| 2024 | 100,000 | 50,000 | 150,000 | 38 | 144,810 | 294,810 |

Sophie Gasperment (1) | 2025 |

|

|

|

|

| 296,665 |

| 2024 | 100,000 | 50,000 | 150,000 | 38 | 144,810 | 294,810 |

Tom Knutzen (1) | 2025 |

|

|

|

|

| 300,415 |

| 2024 | 100,000 | 65,000 | 165,000 | 38 | 144,810 | 309,810 |

Roberto Guidetti (1,6) | 2025 |

|

|

|

|

| 271,665 |

| 2024 | 100,000 | 25,000 | 125,000 | 38 | 144,810 | 269,810 |

Louie D’Amico (1,7) | 2025 |

|

|

|

|

| 61,666 |

Melanie Maas-Brunner (1,6) | 2025 |

|

|

|

|

| 184,999 |

Total compensation (2) | 2025 |

|

|

|

|

| 2,868,199 |

| 2024 |

|

|

|

|

| 2,848,102 |

| 2023 |

|

|

|

|

| 2,986,345 |

The function of each member of the Board of Directors is indicated on pages 12–13 in the 2024 Governance Report and on pages 13–15 in the 2025 Governance Report.

Represents total compensation of the Board of Directors paid with respect to the reporting year, reported in accordance with the accrual principle.

Represents Director and Committee fees paid with respect to the reporting year, reported in accordance with the accrual principle.

2025 RSUs blocking period ends on 15 April 2028; 2024 RSUs ends on 15 April 2027.

Economic value at grant according to IFRS methodology with no discount applied for the blocking period.

2025 figures represent compensation from April to December.

2025 figures represent compensation from October to December.

2025 figures represent compensation from January to March.

Estimated social security charges based on 2025 compensation amounted to CHF 195,734 (2024: CHF 200,409).

Compensation of the Executive Committee

The overall total Executive Committee compensation decreased by 9.1%, reflecting lower annual incentive achievement.

The total compensation for 2025 represented:

- Full year compensation for six Executive Committee members (including CEO).

- Partial year compensation for the former Chief Financial Officer (CFO), Tom Hallam, who stepped down from the Executive Committee on 1 August 2024 and provided transitional services and support on strategic projects until his retirement on 31 January 2025.

- Partial year compensation for Antoine Khalil, who was appointed President Taste & Wellbeing on 1 April 2025.

- Partial year compensation for Louie d’Amico, who stepped down from the Executive Committee on 1 April 2025 and provided transitional services and support on strategic projects until he transitioned to the Board of Directors on 1 October 2025.

Consequently, additional compensation above the shareholder approved amount has been paid in accordance with the Givaudan Articles of Incorporation (Art. 27), which provides that certain supplementary amounts may be paid for newly appointed Executive Committee members within certain thresholds. The compensation paid is within the amounts approved by shareholders in the respective Annual General Meeting. The fixed and long-term variable compensation approved for 2025 was CHF 16,500,000 (2024: CHF 15,600,000). The annual incentive, short-term variable compensation amount for 2025 was CHF 4,561,086 and will be submitted for approval at the 2026 Annual General Meeting (2024: CHF 7,036,528).

Executive Committee (EC) compensation summary

| in Swiss francs | BASE SALARY | PENSION BENEFITS (e) | OTHER BENEFITS (f) | TOTAL FIXED COMPENSATION | ANNUAL INCENTIVE (g) | NUMBER OF PERFORMANCE SHARES GRANTED (h) | VALUE AT GRANT (i) | TOTAL VARIABLE COMPENSATION | TOTAL COMPENSATION | Employer social security j | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Gilles Andrier, CEO | 2025 | 1,279,496 | 584,574 | 180,613 | 2,044,683 | 1,428,312 | 699 | 2,500,463 | 3,928,775 | 5,973,458 | 456,741 |

2024 | 1,257,261 | 582,373 | 204,836 | 2,044,470 | 2,265,274 | 656 | 2,499,885 | 4,765,159 | 6,809,629 | 523,430 | |

| EC members, excluding CEO | 2025 (a) | 3,784,377 | 1,245,193 | 645,192 | 5,674,762 | 3,132,774 | 1,661 | 5,941,729 | 9,074,503 | 14,749,265 | 1,115,304 |

2024 (b) | 3,667,810 | 1,162,437 | 386,788 | 5,217,035 | 4,771,254 | 1,576 | 6,005,821 | 10,777,075 | 15,994,110 | 1,162,790 | |

|

|

|

|

|

|

|

|

|

|

| |

| Total EC members, including CEO | 2025 (c) | 5,063,873 | 1,829,767 | 825,805 | 7,719,445 | 4,561,086 | 2,360 | 8,442,192 | 13,003,278 | 20,722,723 | 1,572,045 |

2024 (d) | 4,925,071 | 1,744,810 | 591,624 | 7,261,505 | 7,036,528 | 2,232 | 8,505,706 | 15,542,234 | 22,803,739 | 1,686,220 |

Represents full year compensation of five Executive Committee members and partial-year compensation of three members: retirement of former CFO (Tom Hallam) and transition of President T&W (Louie d’Amico to Antoine Khalil).

Represents full-year compensation of six Executive Committee members and partial-year compensation of new CFO (Stewart Harris).

Represents full-year compensation of six Executive Committee members (including CEO) and partial-year compensation of three members: retirement of former CFO (Tom Hallam) and transition of President T&W (Louie d’Amico

to Antoine Khalil).Represents full-year compensation of seven Executive Committee members (including CEO) and partial-year compensation of new CFO (Stewart Harris).

Company contributions to broad-based pension and retirement savings plans and annualised expenses accrued for supplementary executive retirement benefit.

Represents annual value of health and welfare plans, international assignment benefits and other benefits in kind.

Annual incentive accrued in the reporting period based on performance in the reporting period.

2025 Performance shares vest on 15 April 2028, 2024 Performance shares vest on 15 April 2027.

Value at grant calculated according to IFRS methodology and based on 100% achievement of performance targets.

2025 estimated social security charges based on 2025 compensation; 2024 estimated social security charges based on 2024 compensation.

Ownership of Givaudan securities

As per 31 December 2025, the Chairman and other Board members, including persons closely connected to them held 3,045 Givaudan shares in total. The Chief Executive Officer and other members of the Executive Committee, including persons closely connected to them, held 6,965 Givaudan shares. One person closely connected to a member of the Executive Committee owned 151 unvested Performance Shares as at 31 December 2025.

Board of Directors

2025 IN NUMBERS | SHARES | BLOCKED | OTHERS |

|---|---|---|---|

Calvin Grieder, Chairman | 1,486 | 524 | |

Victor Balli | 245 | 131 | |

Ingrid Deltenre | 562 | 131 | |

Sophie Gasperment | 562 | 131 | |

Tom Knutzen | 140 | 131 | |

Roberto Guidetti | – | 131 | |

Louie D’Amico1 | 500 | 20 | 1,042 |

Melanie Maas-Brunner | – | 41 |

|

Total 2025 | 3,045 | 1,240 |

|

Total 2024 | 3,519 | 1,262 |

Executive Committee

2025 IN NUMBERS | SHARES | UNVESTED |

|---|---|---|

Gilles Andrier, CEO | 4,369 | 2,258 |

Stewart Harris | 205 | 570 |

Antoine Khalil | 417 | 491 |

Maurizio Volpi | 390 | 1,129 |

Simon Halle-Smith | 343 | 678 |

Willem Mutsaerts | 505 | 678 |

Anne Tayac | 736 | 678 |

Total 2025 | 6,965 | 6,482 |

Total 2024 | 8,400 | 8,010 |

Others relates to Performance Shares that were granted in 2023–2025 for his role as the former President Taste & Wellbeing.

Read more about compensation in our 2025 Governance, Compensation and Financial Report.